III Insurance Certification: Licentiate, Associateship & Fellowship Pathways

Insurance Institute of India Exam 2026 – Complete Exam Schedule and Certification Guide

Planning to take the Insurance Institute of India examination this year? Here’s everything you need to know about III exam registration dates, exam schedules, and certification pathways for 2026.

III Exam 2026 Schedule: Important Exam Dates & Registration Deadlines

If you’re planning to appear for Insurance Institute of India exams in 2026, mark these key dates on your calendar. The III conducts quarterly online examinations throughout the year, and knowing when registration opens is crucial for timely enrollment.

| Exam Session | Registration | Slot booking period | Examination dates | Results Date |

| March 2026 | 5-15 Jan30 Sep | 5th to 11th February 2026 | Saturday 7th & 14th March, Sunday 8th & 15th March 2026 | On or before 31st March 2026 |

| June 2026 | 5th to 15th April 2026 | 5th to 11th May 2026 | Saturday 6th & 13th June, Sunday 7th & 14th June 2026 | On or before 30th June 2026 |

| August-September 2026 | 5th to 15th July 2026 | 1st to 7th August 2026 | Friday 29th August, Saturday 5th September, Sunday 6th September 2026 | 30th September 2026 |

| December 2026 | 5th to 15th October 2026 | 5th to 11th November 2026 | Friday 5th December, Saturday 12th December, Sunday 6th & 13th December 2026 | By 31st December 2026 |

III Professional Examinations: Licentiate, Associateship & Fellowship Levels

The Insurance Institute of India runs a three-level professional examination system designed to support career growth in the insurance industry. Whether you’re just starting out or aiming for senior management positions, III provides structured certification pathways with recognized credentials.

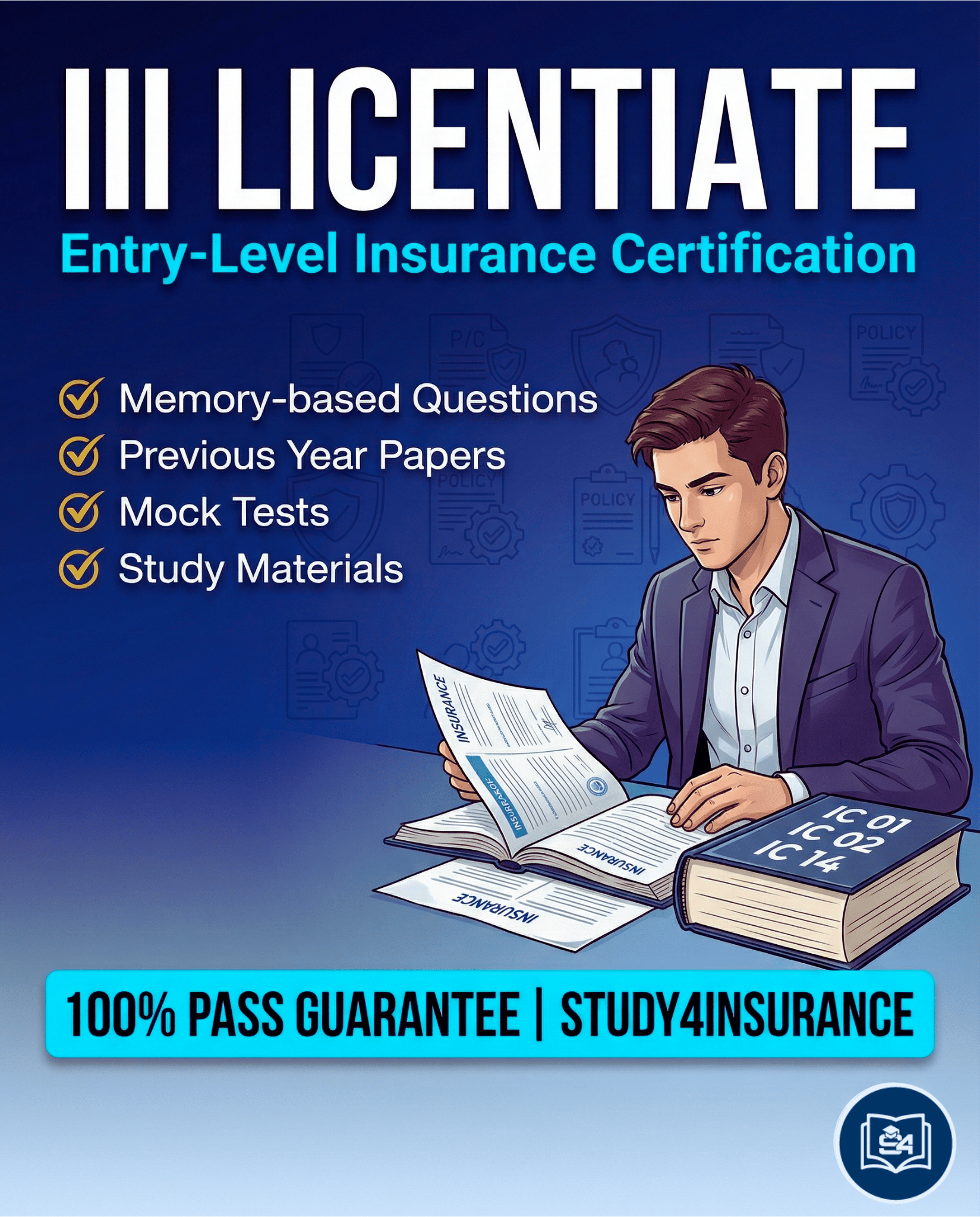

III Licentiate Examination: Entry-Level Insurance Professional Certification

The Licentiate is your entry-level professional certification if you’re looking to build a career in insurance. It covers foundational knowledge in insurance principles and covers both life and general insurance practice areas.

What you’ll study:

- Principles of Insurance (compulsory)

- Practice of Life Insurance or Practice of General Insurance (choose one)

- One additional optional subject from the curriculum

Basic facts about the Licentiate exam:

- Minimum 60 credit points required to pass

- All papers conducted online in multiple-choice format

- 120-minute duration per paper

- Must score at least 60% to pass each subject

- No formal educational qualification required, but basic English and math knowledge is essential

- Distinction awarded for scoring 75% or higher

Why pursue Licentiate? This certification opens doors to insurance agent positions, customer service roles, and entry-level officer positions in insurance companies. Most employers in the insurance sector recognize this as an essential starting qualification.

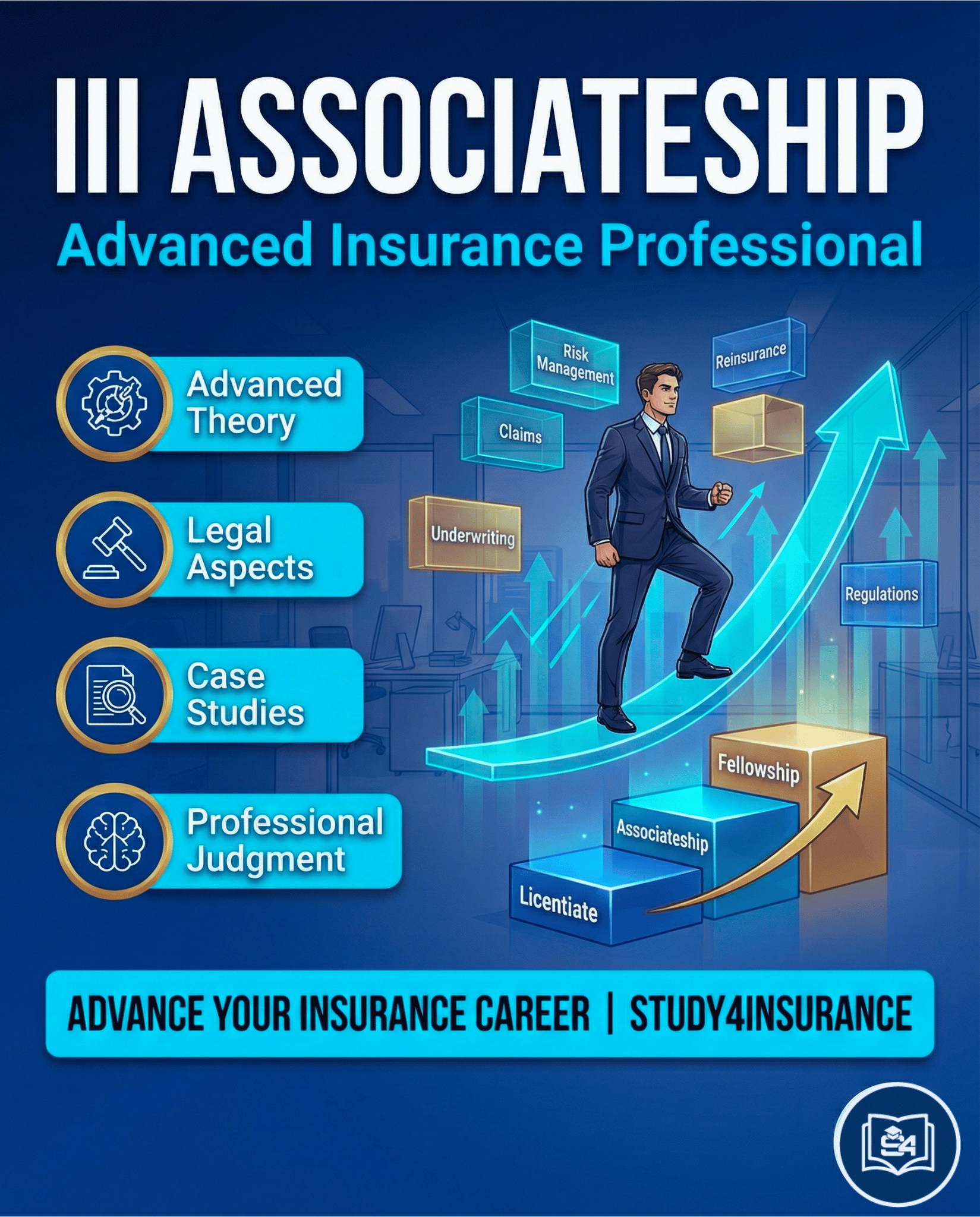

III Associateship Examination: Intermediate Insurance Professional Qualification

Ready to take your insurance career to the next level? The Associateship is the intermediate professional qualification you need. You can only appear for Associateship after successfully passing your Licentiate examination.

Associateship subjects focus on:

- Underwriting principles (compulsory)

- Accounts and financial management (compulsory)

- Choice of specialization in Life or Non-Life insurance

- Various optional subjects in claims, risk management, and regulations

Key details about Associateship:

- Requires minimum 250 total credit points (including 60 from Licentiate)

- Online examination format

- 2-hour duration per paper

- 60% passing score required

- Distinction for 75%+ performance

- No time limit, but credits valid for 5 years

Associateship holders typically move into middle management roles, senior officer positions, and specialist departments. Salary expectations increase significantly with this qualification.

III Fellowship Examination: Senior Insurance Executive Certification

Aiming for executive-level positions in insurance? Fellowship is the highest professional certification offered by III. This is reserved for experienced insurance professionals seeking to demonstrate mastery of advanced concepts.

Fellowship requirements:

- Must pass Associateship first

- Demonstrate commitment to continuing professional development

- Accumulate 490 total credit points (including Licentiate and Associateship credits)

What you’ll cover at Fellowship level:

- Advanced actuarial science subjects

- Strategic management and corporate governance

- Complex risk management frameworks

- Reinsurance and advanced insurance topics

Fellowship examination details:

- Highest difficulty level

- Advanced case studies and real-world scenarios

- 60% minimum passing score

- Distinction for 75%+ marks

- Credit accumulation must happen within 7 years of completing Associateship

Fellowship qualification positions you for Chief Operating Officer, Chief Compliance Officer, and board-level positions in insurance organizations.

III Insurance Surveyor Examination: IRDAI-Recognized Loss Assessor Certification

If you’re interested in claims assessment and loss evaluation, the Insurance Surveyor and Loss Assessor examination offers a specialized career path distinct from the general professional examinations. This pre-licensing test is recognized and authorized by IRDAI (Insurance Regulatory and Development Authority of India).

Who can become an insurance surveyor?

- Hold a relevant bachelor’s degree or diploma (Engineering, Architecture, Law, Accounting, or Insurance)

- Have successfully passed the III Licentiate examination

- Complete mandatory practical training under a licensed senior surveyor

- Register on the IRDAI Brokers and Associates Portal (BAP)

Surveyor examination structure:

- Compulsory paper: Principles of Insurance (S-01)

- Specialized paper: Choose based on your department specialization

- Online Computer-Based Test format

- 60% passing score required in each paper

- IRDAI Surveyor license issued upon successful completion

Departmental specializations available:

- Fire and Engineering Claims

- Motor and Vehicle Claims Assessment

- Marine and Cargo Claims

- Health Insurance Claims

- Miscellaneous and Other Insurance Categories

Why pursue a surveyor career? Insurance surveyors typically earn significantly higher compensation than general insurance professionals. They work independently as licensed loss assessors or with insurance companies conducting claims investigations, damage assessments, and loss verification across various insurance categories.

III CPD Credits: Continuing Professional Development Requirements & Credit System

Once you’ve earned your III professional certification, you’re required to maintain your professional credentials through a structured CPD system. This isn’t a one-time achievement – the insurance industry expects continuous learning and professional development.

Understanding the CPD requirement:

All Insurance Institute of India certificate holders must accumulate 150 credit points each financial year (April to March) to remain in good standing. This ensures professionals stay current with industry developments and regulatory changes.

How CPD credits are organized:

- Academic Work (Maximum 100 credits per year)

- Completing III examination subjects: 8 credits per paper passed

- Publishing articles in insurance journals: 10-30 credits per publication

- Attending III-approved workshops and seminars: 2-5 credits per program

- Online training modules: 1-3 credits per hour

- Organizational Support (Maximum 40 credits per year)

- Conducting insurance training: 3-10 credits per training program

- In-house knowledge-sharing sessions: 1-3 credits per session

- Mentoring junior professionals: 5 credits per mentee annually

- Experience-Based Activities (Maximum 60 credits per year)

- Underwriting experience documentation: 10-20 credits

- Claims handling and assessment: 10-20 credits

- Regulatory compliance work: 5-10 credits

Credit validity and accumulation rules:

- At Licentiate level: 60 minimum credit points needed

- At Associateship level: 250 total credit points required (includes 60 from Licentiate)

- At Fellowship level: 490 total credit points required (includes all previous credits)

- Credits remain valid for 5 years at Licentiate and Associateship levels

- Fellowship credits must accumulate within 7 years of completing Associateship

CPD rewards and recognition:

- Members maintaining 150+ credits for 2 consecutive years receive a Certificate of Appreciation

- Top 25 performers earn cash prizes up to Rs. 10,000

- Public recognition on III website and professional directories

- Enhanced credibility for career advancement and promotion

Registeringfor CPD activities is easy – III provides a web-based portal where you log activities, upload documentation, and track your credit accumulation throughout the year. Many CPD providers are recognized by III and automatically report credits to your profile.

III Exam Eligibility, Format & Guidelines: What You Need to Know

Eligibility basics:

You don’t need any specific educational qualification to appear for III Licentiate examination – anyone working in or planning to enter the insurance industry can register. However, III Life Membership is mandatory through an Associated Institute in your area. If you’ve completed three years of work experience with an insurance company, you’re automatically eligible.

Examination format and structure:

All III professional exams are conducted online as Computer-Based Tests (CBT). You get to choose your preferred exam date, time, and center from available slots on a first-come, first-serve basis. The exam pattern follows Multiple Choice Questions (MCQs) format, with 120 minutes for Licentiate papers and 120 minutes for Associateship and Fellowship papers.

What you can and cannot do in the exam hall:

You’re allowed to bring: valid government-issued photo ID, drinking water bottle. You’re NOT allowed: books, notes, mobile phones, programmable calculators. Simple scientific calculators are permitted but must be your own. Writing your name on answer sheets is strictly forbidden.

Hall tickets and attendance:

You must download your Hall Ticket (Admit Card) from the III portal during slot booking. Physical copies are not posted. The Hall Ticket includes all exam details and instructions. Your photograph and signature are printed on it and must match official records.

Dealing with errors in question papers:

If significant errors are found (10+ questions), the entire paper is canceled and re-examination is conducted at no extra cost. If fewer than 10 errors exist, marks are proportionately adjusted. You have 8 days after your exam to raise grievances about specific questions.

Re-evaluation and recheck:

Re-totaling or revaluation of answer papers is NOT available. Once results are declared and communicated, that’s final. For online exams, you can see your marks immediately after exam completion.

Certificates and diplomas:

Certificates/Diplomas are issued only after meeting minimum credit point requirements and passing all compulsory subjects. These are issued within a month of result declaration. Life Membership is included in your registration fees for Licentiate.

Time limits for completing exams:

There’s no time limit to pass professional examinations – you can appear unlimited times until you qualify. However, once obtained, credits from individual papers remain valid for 5 years at Licentiate/Associateship levels.

III Exam Preparation Tips: Strategies for Passing Insurance Certification Exams

Start early: Don’t wait until the last minute. Most insurance professionals recommend starting Licentiate preparation 2-3 months before your exam. This gives you time to cover concepts without rushing.

Register on time: Mark registration deadlines in your calendar. Late registrations involve extended dates but show less exam flexibility. January, April, July, and October deadlines come up quickly.

Book your slot early: Once enrollment closes, slot booking opens. Popular dates and times fill up fast on a first-come basis. Book your preferred time immediately.

Understand the study material: III study materials are indicative, not exhaustive. You need to stay current with insurance industry developments and regulatory changes. Read financial publications and stay informed about recent IRDAI circulars.

Practice with multiple-choice format: Since all exams follow MCQ pattern, practice extensively with sample papers and mock tests. This helps you get comfortable with the format and improve speed.

Take care of your photographs and signatures: Ensure your profile photo is recent and clear. These are printed on all official documents including Hall Tickets and Certificates.

Plan for online exam: Since all exams happen online from home or an exam center, ensure you have reliable internet connection. Practice navigating the online test interface beforehand.

Stay aware of current insurance topics: Question papers aren’t limited to study course content. You must know about current insurance trends, product changes, and regulatory updates.

Focus on compulsory subjects first: Pass your compulsory papers before attempting optional papers. This ensures you meet the minimum qualification requirements.

Maintain your CPD track record: Even after passing exams, keep track of your CPD activities. Many professionals forget to log activities and face compliance issues later.

Prepare with Study4Insurance: Mock Tests

& Expert-Guided Courses

Study4Insurance offers comprehensive III exam preparation resources designed to help you succeed. Our platform features realistic mock tests that mirror the actual exam format, advanced study materials covering all certification levels, and expert-guided video courses. Practice with our MCQ-based mock tests to build confidence and improve your speed before the actual examination.

Key features of Study4Insurance III Exam Preparation:

- Realistic mock tests designed to match the actual III exam format

- Comprehensive study materials for Licentiate, Associateship, and Fellowship levels

- Expert-guided video courses and detailed concept explanations

- Performance analytics to track your progress and identify weak areas

- Timed practice sessions to improve exam speed and accuracy

- 24/7 access to study resources from any device

Start your III exam preparation today with Study4Insurance. Access our full course library, unlimited mock tests, and expert guidance. Visit Study4Insurance to explore our complete preparation packages and begin your journey toward III certification success.

III Certification Career Pathways: Build Your Insurance Professional Future

The Insurance Institute of India exams open doors to rewarding career opportunities in India’s growing insurance sector. Whether you aim to become an insurance agent, middle-management professional, or executive leader, III certifications provide the credible qualifications employers recognize.

Start your Licentiate preparation today, mark those 2026 exam dates, and take the first step toward building a successful insurance career. Remember, the insurance industry needs skilled, certified professionals—and that could be you.

For the most current exam information, visit www.insuranceinstituteofindia.com or contact your local Associated Institute.

Frequently Asked Questions about III Examinations

What is the minimum educational qualification to appear for III Licentiate examination?

There is no formal minimum educational qualification requirement for the III Licentiate exam. Any individual working in or aspiring to join the insurance industry can apply. However, basic English language proficiency and arithmetic knowledge are essential for understanding exam content.

How many attempts are allowed for III professional examinations?

The III does not impose a limit on the number of attempts for professional examinations. Candidates can appear repeatedly until they achieve the passing score of 60%.

What is the validity period of III certifications once obtained?

III certifications are valid for life once obtained. However, to maintain professional credibility and industry relevance, all certificants must maintain minimum CPD credits (150 points annually) to remain in good standing.

Can I pursue Associateship examination without passing Licentiate?

No. The Licentiate certification is a mandatory prerequisite for Associateship. Candidates must successfully pass Licentiate before appearing for Associateship examination.

What is the salary increase potential after obtaining III Associateship certification?

While salary increases vary based on employer and location, AIII certificants typically see 15-30% salary enhancement compared to non-certified insurance professionals. Senior positions with AIII qualification command significantly higher compensation packages.

Is Fellowship examination mandatory for insurance career advancement?

Fellowship is not mandatory but highly beneficial for career progression into senior management roles. Professionals can build successful careers at Licentiate or Associateship levels; Fellowship certification opens doors to executive positions.

How long does it take to prepare for III Licentiate examination?

Average preparation time varies from 2-4 months of consistent study for most candidates. Those with insurance background may complete preparation in 6-8 weeks, while candidates from non-insurance fields typically require 3-4 months.

What is the difference between insurance surveyor exam and general professional exams?

Surveyor exams focus specifically on claims assessment and damage evaluation skills, while professional exams (Licentiate, Associateship, Fellowship) cover broader insurance knowledge. Surveyors specialize in loss assessment across specific departments like Fire, Motor, or Cargo.

Can I complete CPD credits through workplace experience alone?

No. While experience-based activities (underwriting, claims handling) can earn up to 60 CPD credits yearly, the remaining credits must come from academic activities, training programs, and formal certifications to reach the 150-point annual target.

What happens if I fail to maintain 150 CPD credits annually?

III certificants who consistently fail to maintain minimum CPD credits may face disciplinary action or suspension from III membership. This could impact employment opportunities and professional credibility in the insurance industry.

Is the III Surveyor exam recognised by IRDAI?

Yes. The III Surveyor and Loss Assessor exam is the officially recognized pre-licensing qualification. Upon passing, candidates can register with IRDAI for the Surveyor License through the Brokers and Associates Portal (BAP).

How do I register for III examinations?

Candidates must register through the official III website, submit required documents, pay registration fees, and complete the registration process online. Exam dates are announced quarterly, and candidates can select their preferred examination center.

Are III certifications recognized internationally?

The Insurance Institute of India certifications are primarily recognized in India. However, international insurance companies operating in India recognize III qualifications as valid professional credentials.

What is the cost of pursuing all three professional certifications (Licentiate, Associateship, Fellowship)?

Registration and examination fees vary annually. Approximately, Licentiate costs Rs. 3,000-4,000, Associateship Rs. 5,000-6,000, and Fellowship Rs. 6,000-7,000 per subject. Additional study material costs apply separately.

Can insurance agents pursue III professional exams while working?

Yes. Most insurance professionals pursue III certifications while employed. Online exam format and flexible examination schedules allow working professionals to prepare and appear for exams without career interruption.

Ready to Accelerate Your III Exam Success

with Study4Insurance?

Don’t let exam anxiety hold you back. Study4Insurance provides the structured preparation, proven strategies, and supportive learning environment you need to pass your III exams. Join hundreds of successful insurance professionals who have already transformed their careers with Study4Insurance. Explore our comprehensive courses and unlimited mock tests today.

Professional Insurance Certification: The III system provides a structured, recognized pathway for career advancement in the insurance industry across India.

Three-Tier Progression: Start with Licentiate for foundational knowledge, advance to Associateship for specialization, and pursue Fellowship for executive-level positions.

Specialized Surveyor Track: Insurance professionals interested in claims assessment and loss evaluation have a dedicated pathway through the Surveyor and Loss Assessor examination.

Mandatory Professional Development: CPD system with 150 annual credit points ensures continuous learning, regulatory compliance awareness, and professional credibility maintenance.

Flexible Examination: Online CBT format allows working professionals to pursue certifications without career disruption, with quarterly exam schedules.

Career ROI: III certifications deliver significant career advancement potential, with 15-30% salary increases at Associateship level and executive positioning for Fellowship holders.

Maintain Professional Excellence: Regular CPD engagement, exam preparation, and networking within the insurance community enhance long-term career prospects and industry recognition.

Begin Your III Certification Journey: 2026 Insurance Professional Success Path

The Insurance Institute of India certifications represent India’s most respected professional qualifications in the insurance sector. Whether you’re beginning your career with Licentiate, seeking specialization through Associateship, aiming for executive roles via Fellowship, or pursuing specialized surveyor credentials, the III examination system offers clear pathways for professional growth.

Begin your preparation with dedicated study materials, structured learning modules, and expert guidance. Your commitment to III certifications demonstrates professional excellence and opens unlimited career opportunities in the dynamic Indian insurance industry.

III Licentiate Exam Course

Master insurance fundamentals with IC 01, IC 02, IC 14 modules. Unlimited mock tests, previous year papers, and 100% pass guarantee.

III Associateship Exam

Advance your insurance career with advanced theory, legal aspects, and professional practices. Expert guidance and problem-solving strategies.

III Fellowship Exam

Achieve the highest level of insurance expertise with complex scenarios, case studies, and professional judgment. Expert-crafted solutions.

III Insurance Surveyor Exam

Specialized training in motor, fire, marine insurance, and loss assessment. Get IRDA licensed as an insurance surveyor.

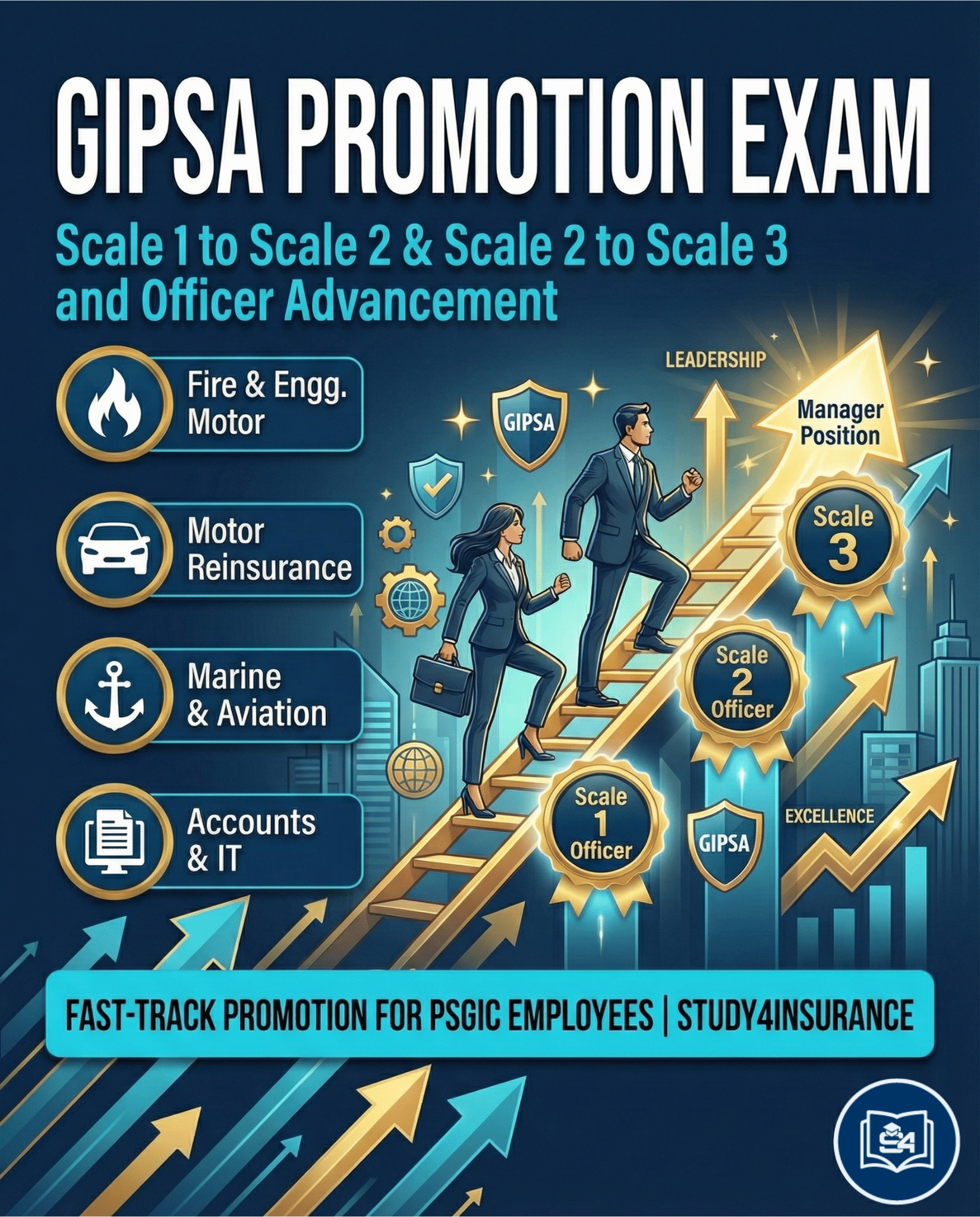

GIPSA Officer Promotion Exam

Fast-track promotion from Scale 1 to Scale 2 for General Insurance PSU employees. GK, reasoning, English, computer knowledge.

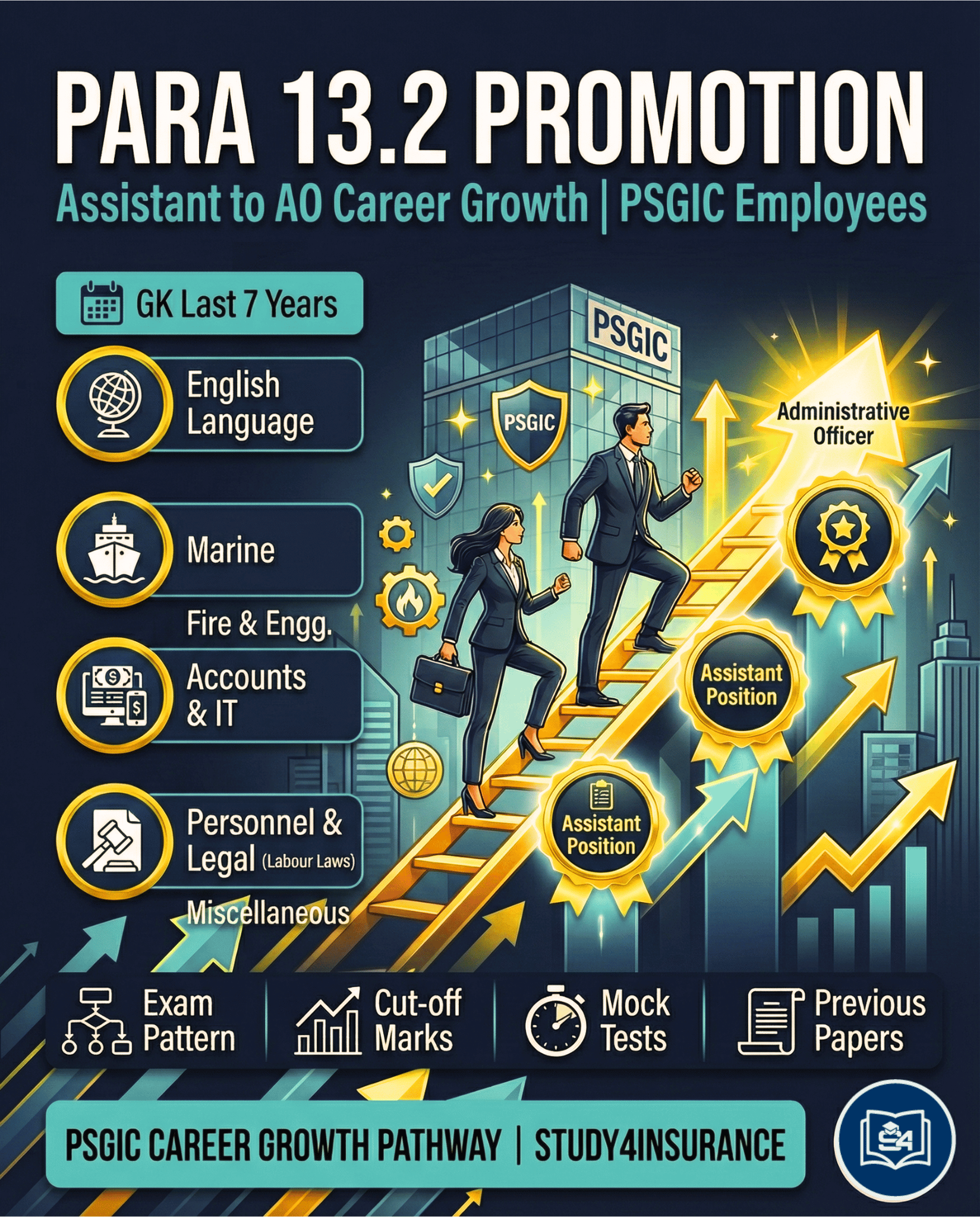

Para 13.2 Promotion Exam

Assistant to AO promotion for PSGIC employees. General knowledge, reasoning, English, computer skills, insurance knowledge.

LIC AAO (1B) Internal Promotion Exam

Insurance knowledge preparation for LIC employees. IC 01, IC 02, IC 14 modules, LIC policy knowledge, 100% pass guarantee.