Master the III Exam Credit Point System: A Complete Guide for Aspirants

Are you planning to build a successful career in the Indian insurance sector? If so, understanding the Insurance Institute of India (III) credit point system is your very first step toward professional growth. Since January 2016, the III Exam has followed a flexible credit-based structure that allows candidates to accumulate points at their own pace.

This guide simplifies the official rules found on the Home page of Study4Insurance to help you plan your journey from Licentiate to Fellowship.

How the III Credit Point System Works

The Insurance Institute of India assigns specific credit points to every subject based on its difficulty and depth. Most importantly, this system offers you the flexibility to choose subjects that truly match your specific career goals. For instance, you can pick specialized subjects that align with your daily work in the industry.

However, you must strictly follow the prescribed sequence. You cannot jump levels without qualifying for the previous ones first. Specifically, you need to clear the Licentiate stage before you can register for the compulsory subjects of the Associateship level. Consequently, the Fellowship stage remains accessible only after you have officially qualified as an Associate.

Breakdown of Exam Levels and Requirements

To earn your professional diplomas, you must accumulate a minimum number of points at each stage. Here is a clear breakdown of the current requirements for various III Exam Courses:

1. Licentiate Certificate (60 Credit Points)

This serves as the entry-level qualification for all insurance professionals. To pass this stage, you must earn a total of 60 points.

- Compulsory Subjects: You must pass IC-01 (Principles of Insurance) along with either IC-02 (Life) or IC-11 (General).

- Electives: Furthermore, you can choose any optional subject to make up the remaining 20 points required for the certificate.

Check our detailed guide on the Licentiate Exam for more information.

2. Associateship Diploma (250 Credit Points)

Once you successfully pass the Licentiate, your next aim is to reach a total of 250 points. Notably, this total already includes the 60 points you earned during the Licentiate level.

- Compulsory Subjects: Candidates must pass one Underwriting paper (IC-22 or IC-45) and one Finance/Accounts paper (IC-26 or IC-46).

- Flexibility: In addition to the compulsory papers, you can pick various optional subjects from the III list to reach the 250-point target.

Visit the Associateship Exam page to explore the full syllabus.

3. Fellowship Diploma (490 Credit Points)

This represents the highest qualification offered by the Institute. You need a grand total of 490 points to qualify, which includes all the points you accumulated at the Associate and Licentiate levels.

- Actuarial Compulsory: Specifically, you must clear at least one actuarial subject such as IC-28, IC-47, or IC-81.

- Final Points: Choose from advanced optional subjects to reach the final 490-point mark and earn your diploma.

Learn more about the elite Fellowship Exam requirements here.

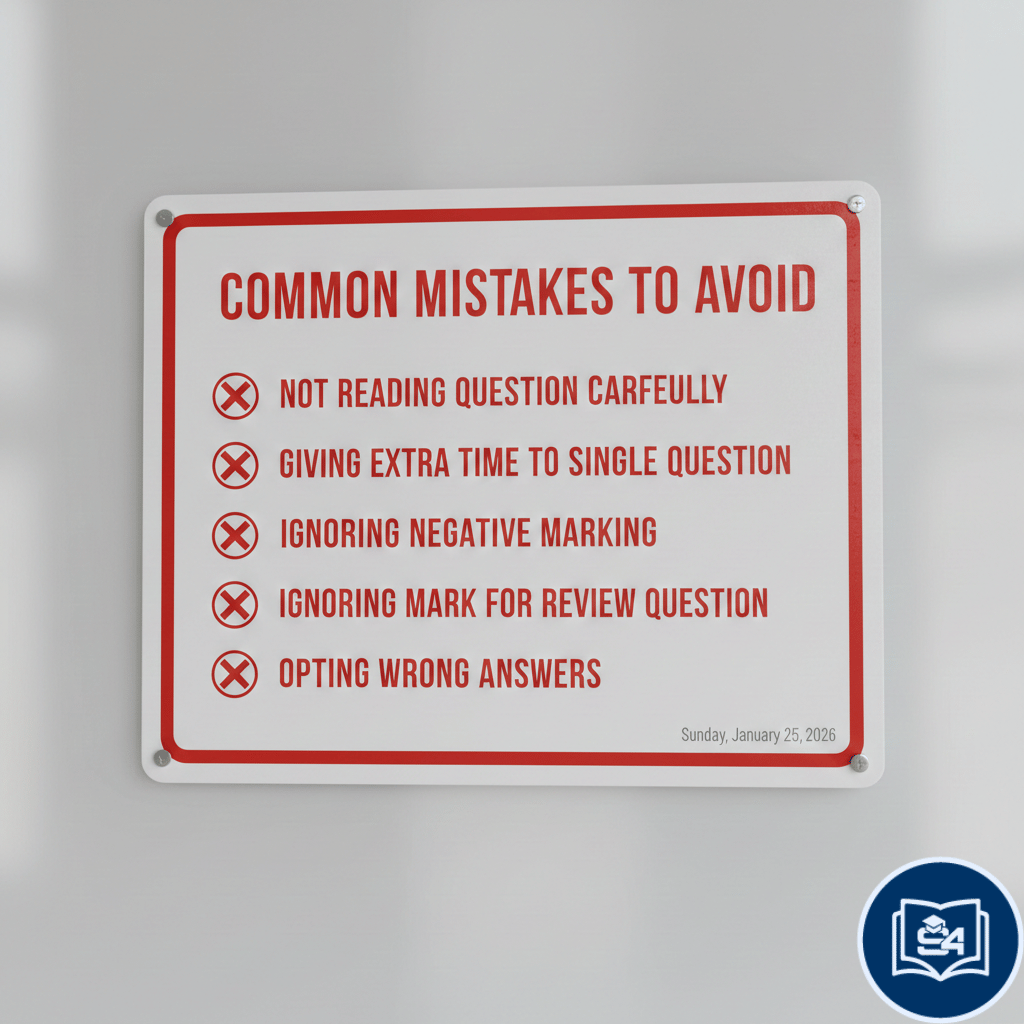

Important Rules for Exam Registration

While the system offers flexibility, there are some strict limits you should keep in mind during your Online Portal Login sessions:

- Subject Limit: You are allowed to appear for a maximum of 6 papers in a single examination cycle.

- Validity: Credit points for individual papers remain valid for a period of 5 years at the Associateship level.

- Permanent Status: Once you complete your Associateship qualification, your 250 credit points become permanent.

- Fellowship Timeline: Consequently, you must complete all Fellowship requirements within 7 years of passing your first paper after the Associate level.

Popular Optional Subjects and Mock Tests

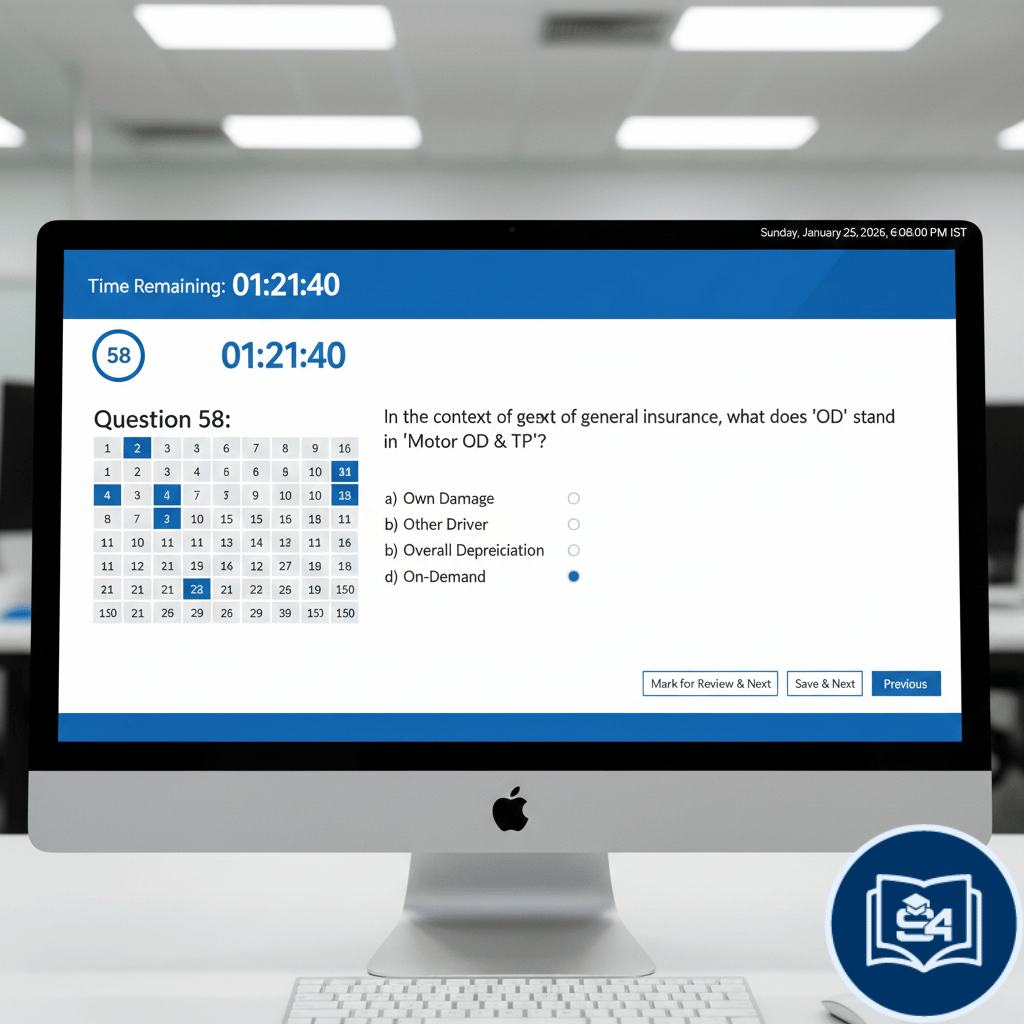

Choosing the right electives can significantly speed up your progress. Many students find success by practicing with our specialized Mock Tests. Here are some common choices among toppers:

- Health Insurance (IC-27): 30 Points

- Motor Insurance (IC-72): 30 Points

- Risk Management (IC-86): 40 Points

- Regulations of Insurance Business (IC-14): 20 Points

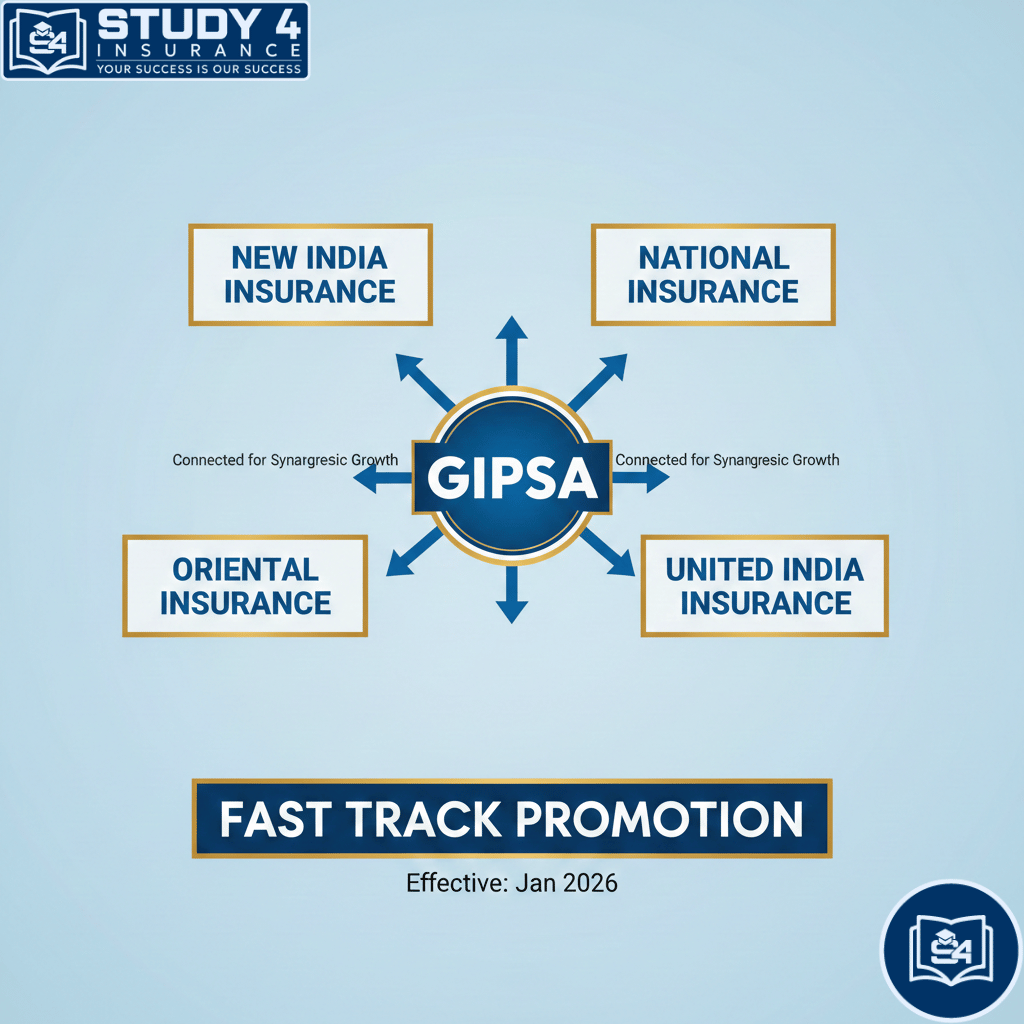

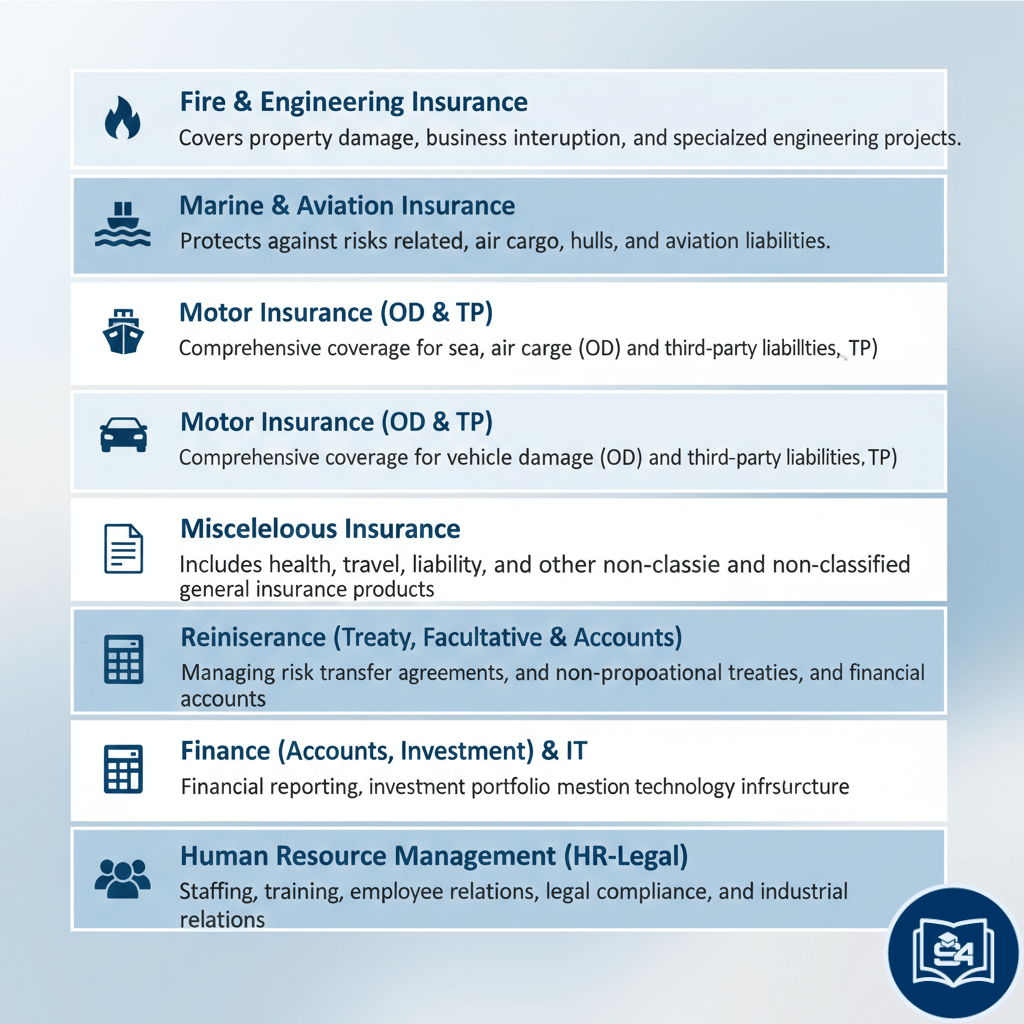

If you are also preparing for other exams, don’t forget to check our resources for the GIPSA Exam, LIC AAO Exam, or the Para 13 Exam.

Conclusion: Start Your Success Journey Today

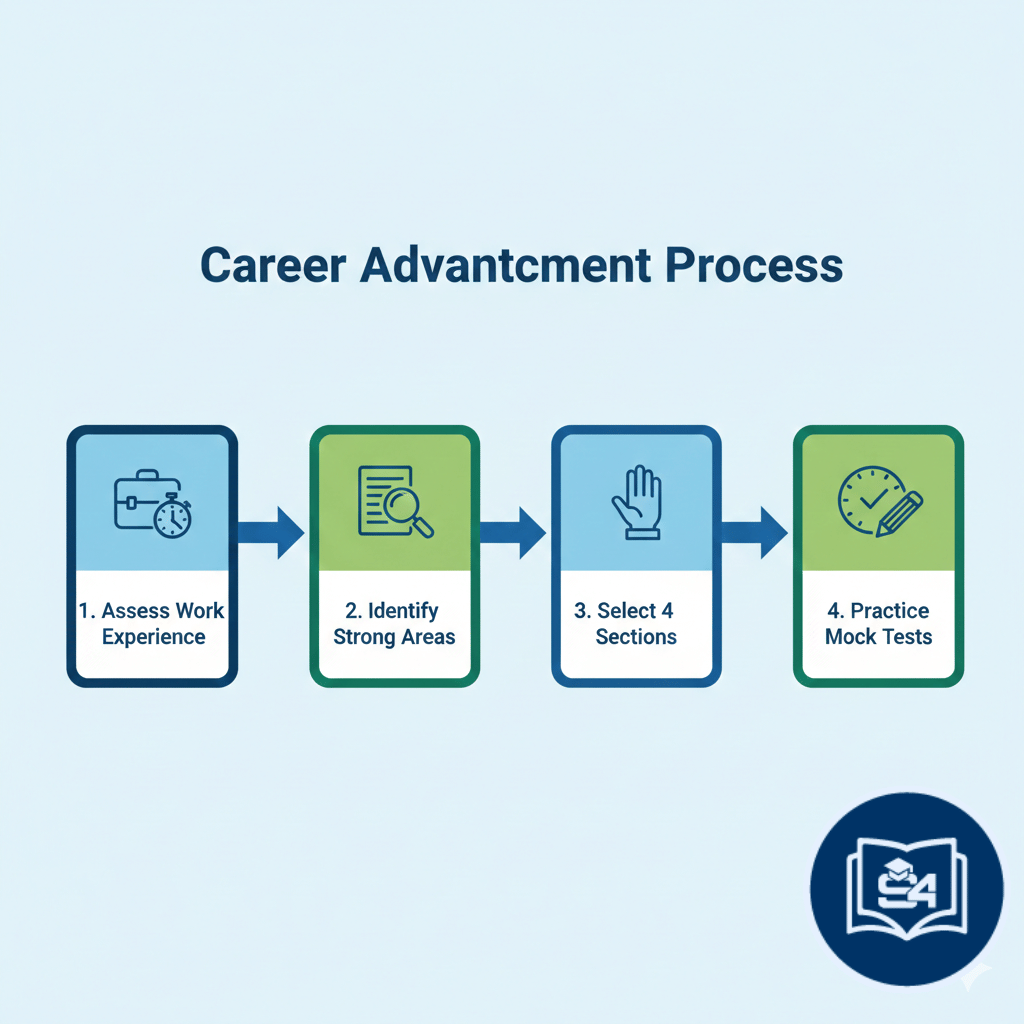

Navigating the III exam system requires careful planning and the right study material. By choosing subjects that align with your current work profile, you can accumulate points faster while gaining practical knowledge. You can also read our Success Stories to see how others have achieved their goals.

Are you looking for high-quality Online Courses? Explore our Online Store or visit the S4I BLOG for more updates.

Do you have questions about specific subject combinations? Join our Telegram Group or our Telegram Community to get expert advice and daily study alerts!